Pension transfer in

Introduction to pension transfer in

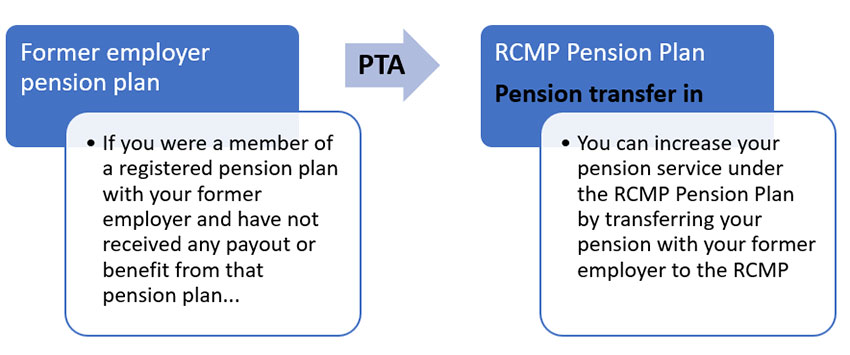

A “pension transfer in” through a Pension transfer agreement (PTA) is when you transfer the monetary value (also known as the actuarial value) of your pension earned under your former employer’s pension plan to the Royal Canadian Mounted Police (RCMP) Pension Plan, allowing you to increase your pension service under the RCMP Pension Plan.

Image description

A PTA needs to be implemented in order to carry on with the process. If you are/were an employee with a different organization and you are preparing to leave or have already left and have never received any payout or benefit from that organization’s pension plan then under the agreed upon PTA you may transfer into the RCMP pension plan. By doing so you may also be able to increase your new pension service under the RCMP pension plan.

No obligation to transfer your pension

There is no obligation to transfer your pension with a former pension plan to your RCMP pension.

Things to consider before proceeding with a pension transfer in

There are many things to consider before proceeding with a pension transfer in such as:

- eligibility

- time limits

- cost

- registered Retirement Savings Plan (RRSP) room implications

- other

Ensure to consult the Pension transfer in considerations for important details on each of the above.

As pensions are complex, you may wish to seek the advice of an independent financial advisor before making a final decision. An independent advisor can be a financial planner, an actuary or an accountant you trust to give you impartial advice and who is qualified to do so. The Government of Canada Pension Centre is also available to answer any questions you may have about your RCMP pension and the PTA process.

The process of pension transfer in

If after carefully reviewing the Pension transfer in considerations you would like to proceed with a pension transfer in, you should review the Pension transfer in administrative process where the following topics are covered:

- estimates

- the transfer in process